Many insurance companies are currently waiving copays and deductibles for telehealth; while some are waiving these fees for all telehealth services, others are limited to COVID-19 related treatment only, and many require that the provider use the insurer’s preferred telemedicine platform.

- Copay For Anthem Blue Cross Blue Shield

- Copays For Blue Cross Coverage

- Copay For Blue Cross Blue Shield

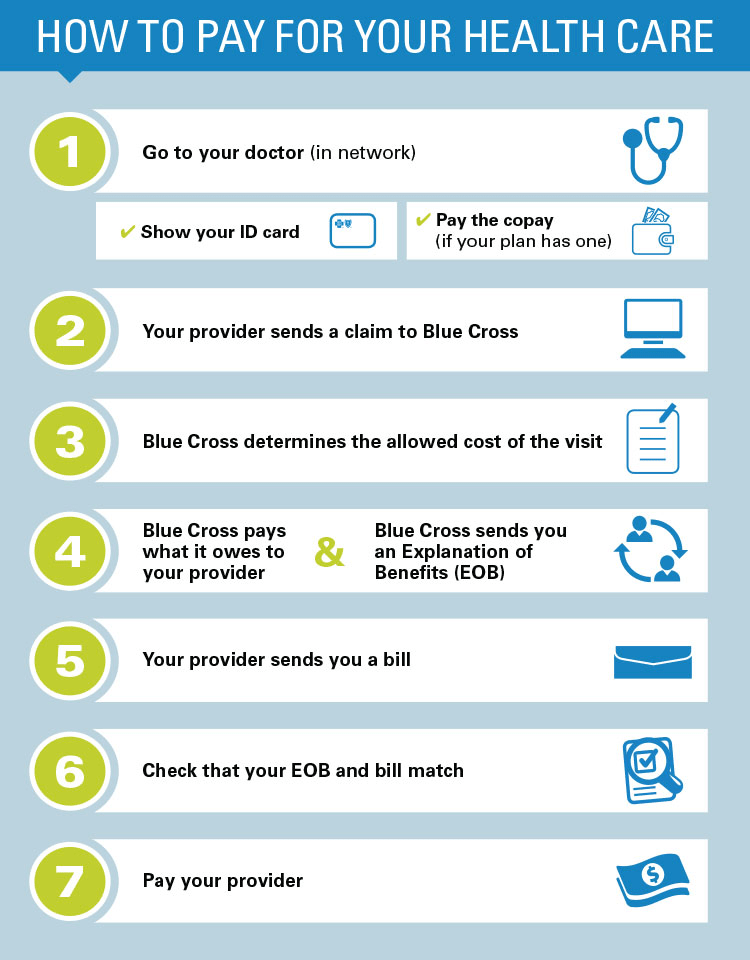

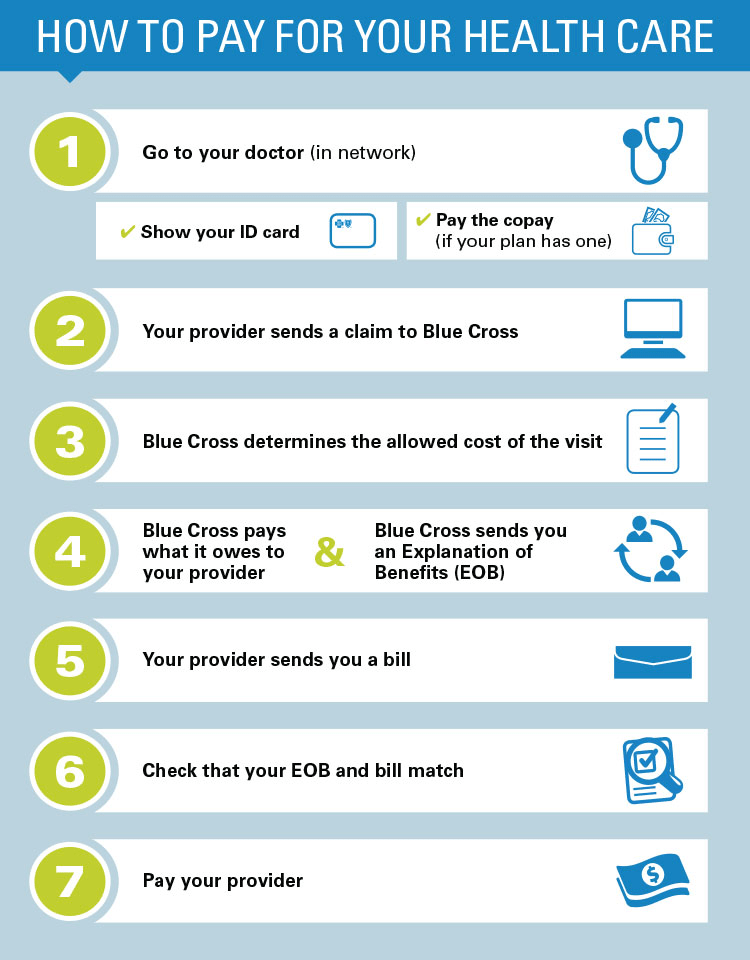

Anthem Blue Cross. Your Plan: PPO Plus Plan. Your Network: National PPO (BlueCard PPO) This summary of benefits is a brief outline of coverage, designed to help you with the selection process. This summary does not reflect each and every benefit, exclusion and limitation which may apply to the coverage. You may have a copay before you’ve finished paying toward your deductible. You may also have a copay after you pay your deductible, and when you owe coinsurance. Your Blue Cross ID card may list copays for some visits. You can also log in to your account, or register for one, on our website or using the mobile app to see your plan’s copays.

Below is a list of health insurance companies, indicating which companies are waiving copays, coinsurances, and deductibles, and if so, when they will return to regular coverage. Most health insurance companies have not released updates since they first made changes in March, but we're keeping a close eye on the situation and will share updates as we have them!

- Call or write us! Medi-Cal: 1-800-407-4627 (TTY 711) MRMIP: 1-877-687-0549 (TTY 711) Anthem Blue Cross is the trade name of Blue Cross of California. Anthem Blue Cross and Blue Cross of California Partnership Plan, Inc. Are independent licensees of the Blue Cross Association.

- 20 copay per visit Not covered Acupuncture $ 20 copay per visit Not covered Other services inan office: Allergy testing $ 20 copay per visit Not covered Chemo/ radiation therapy $ 40 copay per visit Not covered Hemodialysis $ 40 copay per visit Not covered Prescription drugs For the drugs itself dispensed in the office thru infusion/ injection.

For the latest information, we encourage you to visit the linked sources, which will take you to the health insurance company's relevant press release.

Please note that specifics vary across plans, especially employer-issued plans.

Cost-Sharing Waivers By Health Insurance During COVID-19

Aetna

- Cost sharing waived for teletherapy? Yes

- Applicable providers: For all Aetna plans offering Teladoc® coverage, cost sharing will be waived for all Teladoc® virtual visits. For all Commercial plans, cost sharing will also be waived for real-time virtual visits offered by in-network providers.

- Applicable plans: Applies to all Aetna plans; self-insured plan sponsors can opt out.

- Description: Until at least June 4th, 2020, Aetna will waive member cost sharing for any covered telemedicine visits — regardless of diagnosis. For all Aetna plans offering Teladoc® coverage, cost sharing will be waived for all Teladoc® virtual visits. Cost sharing will also be waived for real-time virtual visits offered by in-network providers (live video-conferencing and telephone-only telemedicine services) for all Commercial plan designs. Members may use telemedicine services for any reason, not just COVID-19 diagnosis. Self-insured plan sponsors will be able to opt-out of this program at their discretion.

- Notes: If clients have self-insured plans, it is important to check that the plan has not opted out of the program.

- Sources: Source one, Source two

Allways Health Partners

- Cost sharing waived for teletherapy? Yes

- Applicable providers: All in-network therapists.

- Applicable plans: Not explicitly indicated.

- Description: AllWays Health Partners is removing cost-sharing (copayments, deductibles, or coinsurance) for testing and copayments for treatment at in-network facilities; ensuring access to out-of-network providers for the initial COVID-19 test or treatment when no in-network providers are available; and removing all cost-sharing for telemedicine services, including virtual visits with primary care providers and specialists, and through Partners HealthCare On Demand, to enable members to seek COVID-19-related care without the need to go to medical offices... There will be no cost to you for telemedicine (including telephone) visits for standard/routine outpatient behavioral health.

- Sources:Source

Anthem

- Cost sharing waived for teletherapy? Yes

- Applicable providers: All in-network therapists

- Applicable plans: Applies to all Anthem affiliated plans; self-insured plan sponsors can opt out.

- Description: For 90 days effective March 17, 2020, Anthem’s affiliated health plans will waive member cost shares for telehealth visits, including visits for mental health or substance use disorders, for our fully-insured employer plans, individual plans, Medicare plans and Medicaid plans, where permissible. Cost sharing will be waived for members using Anthem’s authorized telemedicine service, LiveHealth Online, as well as care received from other providers delivering virtual care through internet video + audio services. Self-insured plan sponsors may opt out of this program.

- Sources:Source

Blue Cross Blue Shield Association

- Cost sharing waived for teletherapy? Yes

- Applicable providers: All in-network therapists

- Applicable plans: All 'fully-insured' members

- Description: 'All 36 independently-operated BCBS companies and the Blue Cross and Blue Shield Federal Employee Program® (FEP®) are expanding coverage for telehealth services for the next 90 days. The expanded coverage includes waiving cost-sharing for telehealth services for fully-insured members and applies to in network telehealth providers who are providing appropriate medical services. We are also advocating for physician and health system adoption of social distancing-encouraged capabilities such as video, chat and/or e-visits. This builds on the commitment we previously announced to ensure swift and smooth access to care during the COVID-19 outbreak.'

- Sources:Source

Blue Cross Blue Shield of Massachusetts

- Cost sharing waived for teletherapy? Yes

- Applicable providers: All in-network therapists

- Applicable plans: All members

- Description: 'Blue Cross has waived member cost share (co-pays, co-insurance and deductibles) for all medically necessary medical and behavioral health covered services, via phone or video (telehealth) with in-network providers if such services are offered.'

- Sources: Source

Blue Cross and Blue Shield of Illinois

- Cost sharing waived for teletherapy? Yes

- Applicable providers: All in-network therapists

- Applicable plans: All BCBSIL members with telemedicine/telehealth benefits in their plan (excluding Part D plans for Medicare members)

- Description: 'Currently, if you are insured by BCBSIL, including Medicare (excluding Part D plans) and Medicare Supplement members, you can: Access provider visits for covered services through telemedicine or telehealth as outlined in your benefit plan. You won’t pay copays, deductibles, or coinsurance on in-network covered telemedicine or telehealth services.'

- Sources: Source

Blue Cross and Blue Shield of Rhode Island

- Cost sharing waived for teletherapy? Yes

- Applicable providers: All in-network therapists

- Applicable plans: All members

- Description: Expanded coverage for clinically appropriate telehealth services that are provided by any in-network provider through permitted means, including telephone and audiovisual technologies. Permitted audiovisual capabilities include nonpublic video conferencing such as Skype, Google Hangouts and FaceTime. Waived all member cost sharing (copays and deductibles) for telehealth whether provided by an in-network provider or through the Doctors Online telehealth platform.

- Sources: Source

Blue Shield of California

- Cost sharing waived for teletherapy? Yes, but only for Teladoc Services

- Applicable providers: Only waiving costs for Teladoc Health virtual care service.

- Applicable plans: Applies to Blue Shield’s Individual and Family Plans, Medicare Supplemental plans, Medicare Advantage plans, as well as employer- and union insured plans.

- Description: 'Blue Shield previously announced it is waiving prior approval and copayments for Teladoc Health virtual care service through May 31, 2020 for most of its members. Not all plans have access to these services.'

- Sources:Source

Cigna

- Cost sharing waived for teletherapy? No (only for categories of 'screening, diagnosis, or testing' for COVID-19)

- Applicable providers: N/A

- Applicable plans: N/A

- Description: 'Effective today, Cigna is waiving customer cost-sharing for all COVID-19 treatment through May 31, 2020. The treatments that Cigna will cover for COVID-19 are those covered under Medicare or other applicable state regulations. The company will reimburse health care providers at Cigna's in-network rates or Medicare rates, as applicable. Will Cigna cover Coronavirus virtual care visits? Yes. If your visit is related to screening, diagnosis, or testing for the Coronavirus, your out-of-pocket costs will be waived.'

- Sources: Source

ConnectiCare

- Cost sharing waived for teletherapy? Yes

- Applicable providers: All in-network

- Applicable plans: All members

- Description: 'Today, ConnectiCare, one of the region’s leading health plans, announced that members can temporarily use telehealth for covered medical and mental health services at no cost. To make it easier for our members to get the care they need, ConnectiCare is eliminating the financial burden associated with office visits by covering telehealth appointments for any reason.' The company is allowing no-cost member real time visits with medical and mental health professionals by phone, computer, and mobile app.'

- Sources:Source

EmblemHealth

- Cost sharing waived for teletherapy? Yes

- Applicable providers: All in-network

- Applicable plans: All except potentially not ASO plans

- Description: 'EmblemHealth members across all our product lines will have no cost sharing (including copayments, coinsurance, or deductibles) for in-network telehealth visits. These visits have no cost-sharing for COVID-19 and non-COVID-19 related services. Members with a benefit plan that includes the Teladoc™ program will also have no cost-sharing for Teladoc visits. The telehealth cost-sharing waiver may not apply to ASO plans.'

- Sources:Source

First Choice Health

- Cost sharing waived for teletherapy? No (only for virtual primary care service, not teletherapy)

- Applicable providers: N/A

- Applicable plans: N/A

- Description: 'To help ensure people will have access to a doctor during the current COVID-19 crisis, First Choice Health (FCH), a leading provider-owned healthcare administrator in the Northwest, has announced that it is covering the cost of telehealth services for its self-funded employer customers via on-demand primary care service 98point6.'

- Sources:Source

Harvard Pilgrim Health Care

- Cost sharing waived for teletherapy? Yes

- Applicable providers: All in-network

- Applicable plans: Members on individual and group fully insured plans

- Description: All telemedicine services: Covered in full (no copays, deductibles or coinsurance)

- Sources: Source

Healthfirst

- Cost sharing waived for teletherapy? No (only COVID-19 related testing and evaluation)

- Applicable providers: N/A

- Applicable plans: N/A

- Description: 'Healthfirst is waiving co-pays for all diagnostic testing and evaluations related to coronavirus.'

- Sources: Source

HealthPartners

- Cost sharing waived for teletherapy? No (only COVID-19 related testing and diagnosis)

- Applicable providers: N/A

- Applicable plans: N/A

- Description: 'If you’re a HealthPartners member, you have coverage with no member cost sharing for COVID-19 testing and diagnosis. This includes the cost of the care visit associated with testing.'

- Sources: Source

Kaiser Permanente

- Cost sharing waived for teletherapy? No (only COVID-19 related screening and testing fully covered)

- Applicable providers: N/A

- Applicable plans: N/A

- Description: 'We’re proactively extending the use of telehealth appointments via video and phone where appropriate. As a Kaiser Permanente member, you won’t have to pay for costs related to COVID-19 screening or testing if referred by a Kaiser Permanente doctor. If you’re diagnosed with COVID-19, additional services, including hospital admission (if applicable), will be covered according to your plan details.'

- Sources: Source

Magellan Health

- Cost sharing waived for teletherapy? Yes

- Applicable providers: All in-network therapists

- Applicable plans: All members

- Description: 'As the Centers for Medicare & Medicaid Services (CMS) and the U.S. Department of Health and Human Services (HHS) Office for Civil Rights (OCR) guidance came out on Tuesday, Magellan was revising its operations to permit all credentialed and contracted behavioral health providers to conduct telehealth video sessions for all routine services and certain psychological testing, applied behavior analysis (ABA), intensive outpatient programs (IOP) and partial hospitalization program (PHP) services. Providers are able to use a number of HHS OCR-approved platforms to conduct their telehealth video sessions. Magellan is also allowing telephone-only sessions when a member has no access to a video platform. These alternative approaches will be covered to ensure members get the care they need, when they need it. Our experienced behavioral health network providers are available to serve the needs of our clients’ members through a variety of avenues. We are proud of our network providers and look forward to working with them to support those who may need mental health services as a result of the COVID-19 outbreak.'

- Sources: Source

Neighborhood Health Plan of Rhode Island

- Cost sharing waived for teletherapy? Yes, but only for Optum-based virtual visits

- Applicable providers: Optum virtual visits only for behavioral health

- Applicable plans: All members

- Description: 'Neighborhood’s behavioral health partner Optum, offers virtual visits so you can receive confidential care without leaving your home. For more information on accessing virtual visits, go to live and work well to locate providers and schedule an appointment with them online. Neighborhood has expanded telemedicine coverage for all members to include clinically appropriate and medically necessary services to support you not having to go into your doctor’s office, urgent cares or emergency rooms during the time of the Governor’s executive order. If your plan usually has co pays, deductibles or other cost-sharing, you will not need to pay for the services outlined below. Primary care physicians All Medical Specialists – defined as any MD, DO, NP and PA Optometrists Doctors of Podiatric Medicine (DPM’s) Lactation Consultants Physical, Occupational, and Speech Therapists Diabetes Educators Nutritionists Midwifes Urgent Care Centers Emergency Departments Retail Based Clinics'

- Sources: Source

Oscar

- Cost sharing waived for teletherapy? No; standard cost sharing rules apply for teletherapy

- Applicable providers: Offering Oscar's Doctor on Call for 'most members' free of charge

- Applicable plans: Varies depending on details of individual plans

- Description: 'In addition to offering Oscar's Doctor on Call services to most members for $0, Oscar will cover all COVID-19 care delivered via telemedicine at $0 for our members through May 10. We will re-evaluate this date as needed. Oscar will also cover telemedicine care, consistent with our plan terms, for our members when they see an in-network provider through May 10. Standard cost-sharing rules will apply in all states except New York and New Jersey. In these states, members will pay $0 for any medically-necessary telemedicine visit with an in-network provider.'

- Sources: Source

Premera Blue Cross

- Cost sharing waived for teletherapy? No; only through certain platforms

- Applicable providers: Specific services only (Talkspace for therapy)

- Applicable plans: Varies depending on 'participating groups'

- Description: 'To ease the burden for our members, we will waive copays, deductibles, and coinsurance for COVID-19 related treatment (both inpatient and outpatient). This waiver will continue through October 1, 2020 for participating groups. We've expanded options for you: Call your in-network primary care doctor's office. 24-Hour NurseLine is available at no charge. Just call the number on the back of your member ID card to reach medical professionals. Doctor On Demand is a video chat with a doctor. 98point6 is a text-based primary care app. Talkspace offers virtual access to licensed therapists.'

- Sources: Source

UnitedHealthcare

- Cost sharing waived for teletherapy? Yes

- Applicable providers: All in-network therapists

- Applicable plans: Medicare Advantage, Medicaid, Individual and Group Market fully insured health plans

- Description: 'Starting March 31, 2020 until June 18, 2020, UnitedHealthcare will now also waive cost-sharing for in-network, non-COVID-19 telehealth visits for its Medicare Advantage, Medicaid, Individual and Group Market fully insured health plans. Again, we will work with self-funded customers who want us to implement a similar approach. The company previously announced we would waive cost-sharing for telehealth visits related to COVID-19 testing, in addition to waiving cost-sharing for 24/7 Virtual Visits with preferred telehealth partners.'

- Sources: Source

Medicare coverage

For the duration of the Public Health Emergency (PHE) declared by the Secretary of Health and Human Services, CMS will be making these changes. The main note is that there will no longer be a limit on the originating site -- the place where a client or patient is receiving care. Clients can now temporarily receive telehealth visits in their home, regardless of whether they are located in a rural area.

Waived Cost End Dates

Insurance companies are planning to waive fees until the dates listed below. They will be re-evaluating and updating these dates as the situation progresses.

- Aetna: June 4, 2020 (source)

- Anthem: June 15, 2020 (source)

- Cigna: May 31, 2020 (source)

- Blue Cross Blue Shield: June 15, 2020 (source) ('All 36 independently-operated BCBS companies and the Blue Cross and Blue Shield Federal Employee Program® (FEP®) are expanding coverage for telehealth services for the next 90 days. The expanded coverage includes waiving cost-sharing for telehealth services for fully-insured members and applies to in network telehealth providers who are providing appropriate medical services.' 90 days from the publication date of this press release of March 19th, 2020, takes us to about June 15th, 2020 (calculation), which is how we arrived at this end date.)

- Empire Blue Cross Blue Shield: June 15, 2020 (or “as long as the COVID-19 emergency is in effect.”) (source)

- UnitedHealthcare: June 18, 2020 (source)

Grow Your Practice With Zencare!

We're looking for clinically excellent and compassionate therapists and psychiatrists to refer clients to. We'd love to learn about your practice!

Jump to:

Anthem MediBlue Access (PPO) H8552-029 is a 2021 Medicare Advantage Plan or Medicare Part-C plan by Anthem Blue Cross Life and Health Insurance Co available to residents in California. This plan includes additional Medicare prescription drug (Part-D) coverage. The Anthem MediBlue Access (PPO) has a monthly premium of $30.00 and has an in-network Maximum Out-of-Pocket limit of $6,700 (MOOP). This means that if you get sick or need a high cost procedure the co-pays are capped once you pay $6,700 out of pocket. This can be a extremely nice safety net.

Anthem MediBlue Access (PPO) is a Local PPO. A preferred provider organization (PPO) is a Medicare plan that has created contracts with a network of 'preferred' providers for you to choose from at reduced rates. You do not need to select a primary care physician and you do not need referrals to see other providers in the network. Offering you a little more flexibility overall. You can get medical attention from a provider outside of the network but you will have to pay the difference between the out-of-network bill and the PPOs discounted rate.

Anthem Blue Cross Life and Health Insurance Co works with Medicare to provide significant coverage beyond Part A and Part B benefits. If you decide to sign up for Anthem MediBlue Access (PPO) you still retain Original Medicare. But you will get additional Part A (Hospital Insurance) and Part B (Medical Insurance) coverage from Anthem Blue Cross Life and Health Insurance Co and not Original Medicare. With Medicare Advantage Plans you are always covered for urgently needed and emergency care. Plus you receive all of the benefits of Original Medicare from Anthem Blue Cross Life and Health Insurance Co except hospice care. Original Medicare still provides you with hospice care even if you sign up for a Medicare Advantage Plan.

Ready to Enroll?

Or Call

1-855-778-4180

Mon-Fri 8am-9pm EST

Sat 9am-9pm EST

2021 Anthem Blue Cross Life and Health Insurance Co Medicare Advantage Plan Costs

| Name: |

|---|

| Plan ID: | H8552-029 |

|---|

| Provider: | Anthem Blue Cross Life and Health Insurance Co |

|---|

| Year: | 2021 |

|---|

| Type: | Local PPO |

|---|

| Monthly Premium C+D: | $30.00 |

|---|

| Part C Premium: | $0 |

|---|

| MOOP: | $6,700 |

|---|

| Part D (Drug) Premium: | $30.00 |

|---|

| Part D Supplemental Premium | $0 |

|---|

| Total Part D Premium: | $30.00 |

|---|

| Drug Deductible: | $370.0 |

|---|

| Tiers with No Deductible: | 1 |

|---|

| Gap Coverage: | No |

|---|

| Benchmark: | not below the regional benchmark |

|---|

| Type of Medicare Health: | Enhanced Alternative |

|---|

| Drug Benefit Type: | Enhanced |

|---|

| Similar Plan: | H8552-020 |

|---|

Anthem MediBlue Access (PPO) Part-C Premium

Anthem Blue Cross Life and Health Insurance Co plan charges a $0 Part-C premium. The Part C premium covers Medicare medical, hospital benefits and supplemental benefits if offered. You generally are also responsible for paying the Part B premium.

H8552-029 Part-D Deductible and Premium

Anthem MediBlue Access (PPO) has a monthly drug premium of $30.00 and a $370.0 drug deductible. This Anthem Blue Cross Life and Health Insurance Co plan offers a $30.00 Part D Basic Premium that is not below the regional benchmark. This covers the basic prescription benefit only and does not cover enhanced drug benefits such as medical benefits or hospital benefits. The Part D Supplemental Premium is $0 this Premium covers any enhanced plan benefits offered by Anthem Blue Cross Life and Health Insurance Co above and beyond the standard PDP benefits. This can include additional coverage in the gap, lower co-payments and coverage of non-Part D drugs. The Part D Total Premium is $30.00. The Part D Total Premium is the addition of the supplemental and basic premiums for some plans this amount can be lower due to negative basic or supplemental premiums.

Anthem Blue Cross Life and Health Insurance Co Gap Coverage

In 2021 once you and your plan provider have spent $4130 on covered drugs. (combined amount plus your deductible) You will be in the coverage gap. (AKA 'donut hole') You will be required to pay 25% for prescription drugs unless your plan offers additional coverage. This Anthem Blue Cross Life and Health Insurance Co plan does not offer additional coverage through the gap.

Premium Assistance

The Low Income Subsidy (LIS) helps people with Medicare pay for prescription drugs, and lowers the costs of Medicare prescription drug coverage. Depending on your income level you may be eligible for full 75%, 50%, 25% premium assistance. The Anthem MediBlue Access (PPO) medicare insurance offers a $0 premium obligation if you receive a full low-income subsidy (LIS) assistance. And the payment is $7.50 for 75% low income subsidy $15.00 for 50% and $22.50 for 25%.

| Full LIS Premium: | $0 |

|---|

| 75% LIS Premium: | $7.50 |

|---|

| 50% LIS Premium: | $15.00 |

|---|

| 25% LIS Premium: | $22.50 |

|---|

H8552-029 Formulary or Drug Coverage

Anthem MediBlue Access (PPO) formulary is divided into tiers or levels of coverage based on usage and according to the medication costs. Each tier will have a defined copay that you must pay to receive the drug. Drugs in lower tiers will usually cost less than those in higher tiers.By reviewing different Medicare Drug formularies, you can pick a Medicare Advantage plan that covers your medications. Additionally, you can choose a plan that has your drugs listed at a lower price.

2021 Anthem MediBlue Access (PPO) Summary of Benefits

Additional Benefits

Comprehensive Dental

| Diagnostic services | Not covered |

|---|

| Endodontics | Not covered |

|---|

| Extractions | Not covered |

|---|

| Non-routine services | Not covered |

|---|

| Periodontics | Not covered |

|---|

| Prosthodontics, other oral/maxillofacial surgery, other services | Not covered |

|---|

| Restorative services | Not covered |

|---|

Deductible

Diagnostic Tests and Procedures

| Diagnostic radiology services (e.g., MRI) | $75 copay |

|---|

| Diagnostic radiology services (e.g., MRI) | 40% coinsurance (Out-of-Network) |

|---|

| Diagnostic tests and procedures | $0-75 copay |

|---|

| Diagnostic tests and procedures | 40% coinsurance (Out-of-Network) |

|---|

| Lab services | 40% coinsurance (Out-of-Network) |

|---|

| Lab services | $0-5 copay |

|---|

| Outpatient x-rays | $25 copay |

|---|

| Outpatient x-rays | 40% coinsurance (Out-of-Network) |

|---|

Doctor Visits

| Primary | $10 copay per visit |

|---|

| Primary | $30 copay per visit (Out-of-Network) |

|---|

| Specialist | $35 copay per visit |

|---|

| Specialist | $50 copay per visit (Out-of-Network) |

|---|

Emergency care/Urgent Care

| Emergency | $90 copay per visit (always covered) |

|---|

| Urgent care | $30 copay per visit (always covered) |

|---|

Foot Care (podiatry services)

| Foot exams and treatment | $35 copay |

|---|

| Foot exams and treatment | $50 copay (Out-of-Network) |

|---|

| Routine foot care | Not covered |

|---|

Ground Ambulance

| $325 copay (Out-of-Network) |

|---|

| $325 copay |

|---|

Hearing

| Fitting/evaluation | 20% coinsurance (Out-of-Network) |

|---|

| Fitting/evaluation | $0 copay |

|---|

| Hearing aids | $0 copay |

|---|

| Hearing aids | $0 copay (Out-of-Network) |

|---|

| Hearing exam | 40% coinsurance (Out-of-Network) |

|---|

| Hearing exam | $35 copay |

|---|

Inpatient Hospital Coverage

$175 per day for days 1 through 7

$0 per day for days 8 through 90 |

|---|

| 40% per stay (Out-of-Network) |

|---|

Medical Equipment/Supplies

| Diabetes supplies | 40% coinsurance per item (Out-of-Network) |

|---|

| Diabetes supplies | $0 copay |

|---|

| Durable medical equipment (e.g., wheelchairs, oxygen) | 40% coinsurance per item (Out-of-Network) |

|---|

| Durable medical equipment (e.g., wheelchairs, oxygen) | 0-20% coinsurance per item |

|---|

| Prosthetics (e.g., braces, artificial limbs) | 20% coinsurance per item |

|---|

| Prosthetics (e.g., braces, artificial limbs) | 40% coinsurance per item (Out-of-Network) |

|---|

Medicare Part B Drugs

| Chemotherapy | 40% coinsurance (Out-of-Network) |

|---|

| Chemotherapy | 20% coinsurance |

|---|

| Other Part B drugs | 40% coinsurance (Out-of-Network) |

|---|

| Other Part B drugs | 20% coinsurance |

|---|

Mental Health Services

| Inpatient hospital - psychiatric | $175 per day for days 1 through 7

$0 per day for days 8 through 90 |

|---|

| Inpatient hospital - psychiatric | 40% per stay (Out-of-Network) |

|---|

| Outpatient group therapy visit | $20 copay |

|---|

| Outpatient group therapy visit | $50 copay (Out-of-Network) |

|---|

| Outpatient group therapy visit with a psychiatrist | $50 copay (Out-of-Network) |

|---|

| Outpatient group therapy visit with a psychiatrist | $20 copay |

|---|

| Outpatient individual therapy visit | $50 copay (Out-of-Network) |

|---|

| Outpatient individual therapy visit | $20 copay |

|---|

| Outpatient individual therapy visit with a psychiatrist | $20 copay |

|---|

| Outpatient individual therapy visit with a psychiatrist | $50 copay (Out-of-Network) |

|---|

MOOP

$10,000 In and Out-of-network

$6,700 In-network |

|---|

Option

Optional supplemental benefits

Outpatient Hospital Coverage

| $0-175 copay per visit |

|---|

| 40% coinsurance per visit (Out-of-Network) |

|---|

Package #1

| Deductible |

|---|

| Monthly Premium | $23.00 |

|---|

Package #2

| Deductible |

|---|

| Monthly Premium | $35.00 |

|---|

Package #3

| Deductible |

|---|

| Monthly Premium | $58.00 |

|---|

Preventive Care

| $0 copay |

|---|

| 40% coinsurance (Out-of-Network) |

|---|

Preventive Dental

| Cleaning | $0 copay |

|---|

| Cleaning | 20% coinsurance (Out-of-Network) |

|---|

| Dental x-ray(s) | Not covered |

|---|

| Fluoride treatment | Not covered |

|---|

| Oral exam | $0 copay |

|---|

| Oral exam | 20% coinsurance (Out-of-Network) |

|---|

Rehabilitation Services

| Occupational therapy visit | $50 copay (Out-of-Network) |

|---|

| Occupational therapy visit | $25 copay |

|---|

| Physical therapy and speech and language therapy visit | $25 copay |

|---|

| Physical therapy and speech and language therapy visit | $50 copay (Out-of-Network) |

|---|

Skilled Nursing Facility

$0 per day for days 1 through 20

$140 per day for days 21 through 100 |

|---|

| 40% per stay (Out-of-Network) |

|---|

Transportation

Vision

| Contact lenses | $0 copay (Out-of-Network) |

|---|

| Contact lenses | $0 copay |

|---|

| Eyeglass frames | $0 copay |

|---|

| Eyeglass frames | $0 copay (Out-of-Network) |

|---|

| Eyeglass lenses | $0 copay (Out-of-Network) |

|---|

| Eyeglass lenses | $0 copay |

|---|

| Eyeglasses (frames and lenses) | $0 copay (Out-of-Network) |

|---|

| Eyeglasses (frames and lenses) | $0 copay |

|---|

| Other | Not covered |

|---|

| Routine eye exam | $0 copay (Out-of-Network) |

|---|

| Routine eye exam | $0 copay |

|---|

| Upgrades | Not covered |

|---|

Wellness Programs (e.g. fitness nursing hotline)

Reviews for Anthem MediBlue Access (PPO) H8552

| 2019 Overall Rating |

|---|

| Part C Summary Rating |

|---|

| Part D Summary Rating |

|---|

| Staying Healthy: Screenings, Tests, Vaccines |

|---|

| Managing Chronic (Long Term) Conditions |

|---|

| Member Experience with Health Plan |

|---|

| Complaints and Changes in Plans Performance |

|---|

| Health Plan Customer Service |

|---|

| Drug Plan Customer Service |

|---|

| Complaints and Changes in the Drug Plan |

|---|

| Member Experience with the Drug Plan |

|---|

| Drug Safety and Accuracy of Drug Pricing |

|---|

Staying Healthy, Screening, Testing, & Vaccines

| Total Preventative Rating |

|---|

| Breast Cancer Screening |

|---|

| Colorectal Cancer Screening |

|---|

| Annual Flu Vaccine |

|---|

| Improving Physical |

|---|

| Improving Mental Health |

|---|

| Monitoring Physical Activity |

|---|

| Adult BMI Assessment |

|---|

Managing Chronic And Long Term Care for Older Adults

| Total Rating |

|---|

| SNP Care Management |

|---|

| Medication Review |

|---|

| Functional Status Assessment |

|---|

| Pain Screening |

|---|

| Osteoporosis Management |

|---|

| Diabetes Care - Eye Exam |

|---|

| Diabetes Care - Kidney Disease |

|---|

| Diabetes Care - Blood Sugar |

|---|

| Rheumatoid Arthritis |

|---|

| Reducing Risk of Falling |

|---|

| Improving Bladder Control |

|---|

| Medication Reconciliation |

|---|

| Statin Therapy |

|---|

Member Experience with Health Plan

| Total Experience Rating |

|---|

| Getting Needed Care |

|---|

| Customer Service |

|---|

| Health Care Quality |

|---|

| Rating of Health Plan |

|---|

| Care Coordination |

|---|

Member Complaints and Changes in Anthem MediBlue Access (PPO) Plans Performance

| Total Rating |

|---|

| Complaints about Health Plan |

|---|

| Members Leaving the Plan |

|---|

| Health Plan Quality Improvement |

|---|

| Timely Decisions About Appeals |

|---|

Health Plan Customer Service Rating for Anthem MediBlue Access (PPO)

| Total Customer Service Rating |

|---|

| Reviewing Appeals Decisions |

|---|

| Call Center, TTY, Foreign Language |

|---|

Anthem MediBlue Access (PPO) Drug Plan Customer Service Ratings

| Total Rating |

|---|

| Call Center, TTY, Foreign Language |

|---|

| Appeals Auto |

|---|

| Appeals Upheld |

|---|

Ratings For Member Complaints and Changes in the Drug Plans Performance

| Total Rating |

|---|

| Complaints about the Drug Plan |

|---|

| Members Choosing to Leave the Plan |

|---|

| Drug Plan Quality Improvement |

|---|

Member Experience with the Drug Plan

| Total Rating |

|---|

| Rating of Drug Plan |

|---|

| Getting Needed Prescription Drugs |

|---|

Drug Safety and Accuracy of Drug Pricing

| Total Rating |

|---|

| MPF Price Accuracy |

|---|

| Drug Adherence for Diabetes Medications |

|---|

| Drug Adherence for Hypertension (RAS antagonists) |

|---|

| Drug Adherence for Cholesterol (Statins) |

|---|

| MTM Program Completion Rate for CMR |

|---|

| Statin with Diabetes |

|---|

Ready to Enroll?

Or Call

1-855-778-4180

Mon-Sat 8am-11pm EST

Sun 9am-6pm EST

Copay For Anthem Blue Cross Blue Shield

Copays For Blue Cross Coverage

Coverage Area for Anthem MediBlue Access (PPO)

(Click county to compare all available Advantage plans)

| State: | California

|

|---|

| County: | Butte,El Dorado,Napa,Shasta,Solano,

Sonoma,Sutter,Tehama,Yuba,

|

|---|

Go to top

Copay For Blue Cross Blue Shield

Source: CMS.

Data as of September 9, 2020.

Notes: Data are subject to change as contracts are finalized. For 2021, enhanced alternative may offer additional cost sharing reductions in the gap on a sub-set of the formulary drugs, beyond the standard Part D benefit.Includes 2021 approved contracts. Employer sponsored 800 series and plans under sanction are excluded.